One of the main challenges in assessing the risk of doing business with private companies in emerging markets is the limited availability and reliability of data. Quite simply, if you can't trust the accuracy of the information you have, or the validity of your sources, it's impossible to make well-founded judgements.

EMIS can help you to:

Optimise your valuations

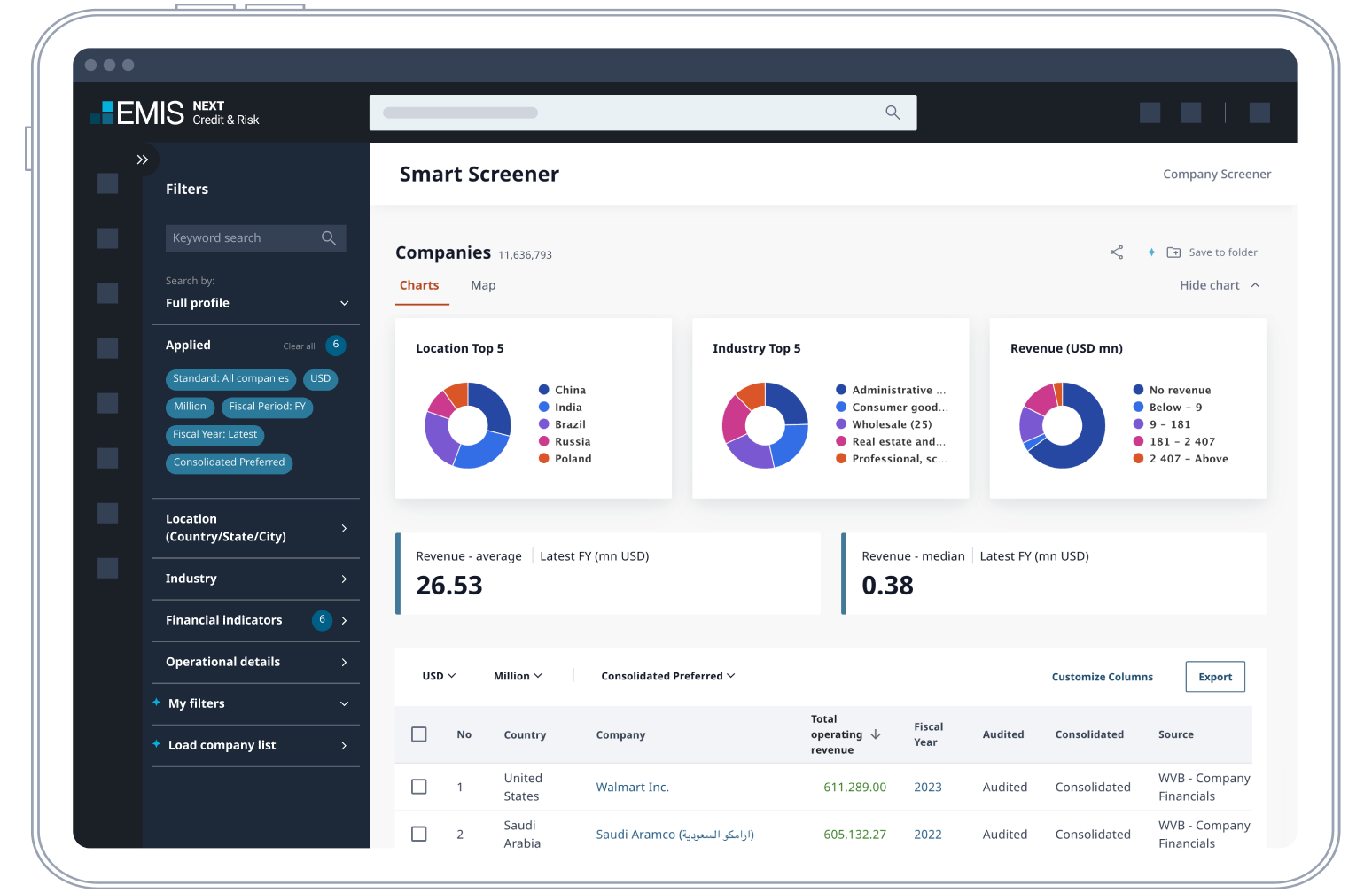

Collect accurate, up-to-date long-term financial information for companies.

Easily manage credit portfolios

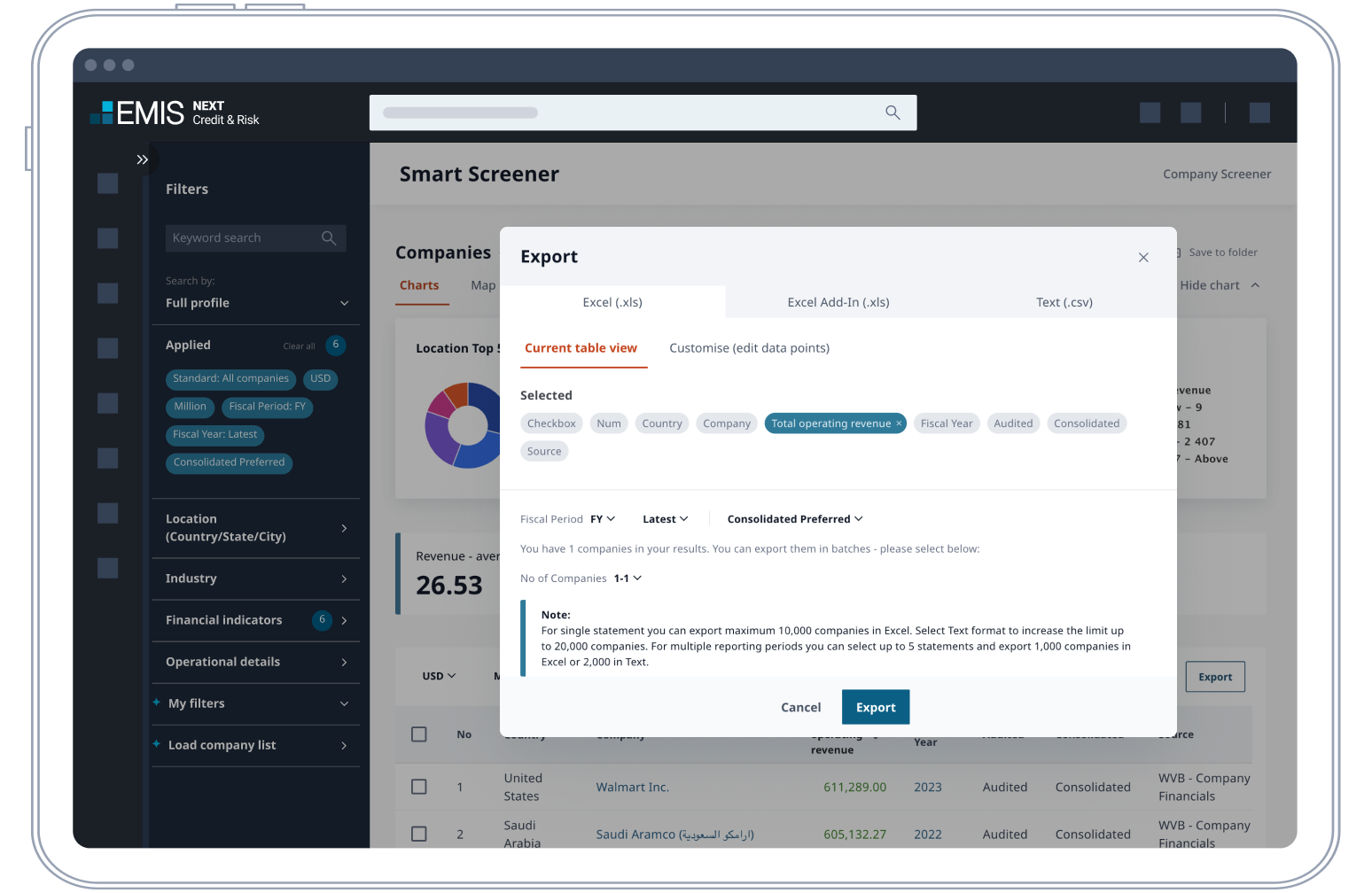

Export data directly into your own templates and refresh it automatically.

Reduce risk

Conduct in-depth reviews of companies and executives as well as peer analysis.

Simplify credit limits

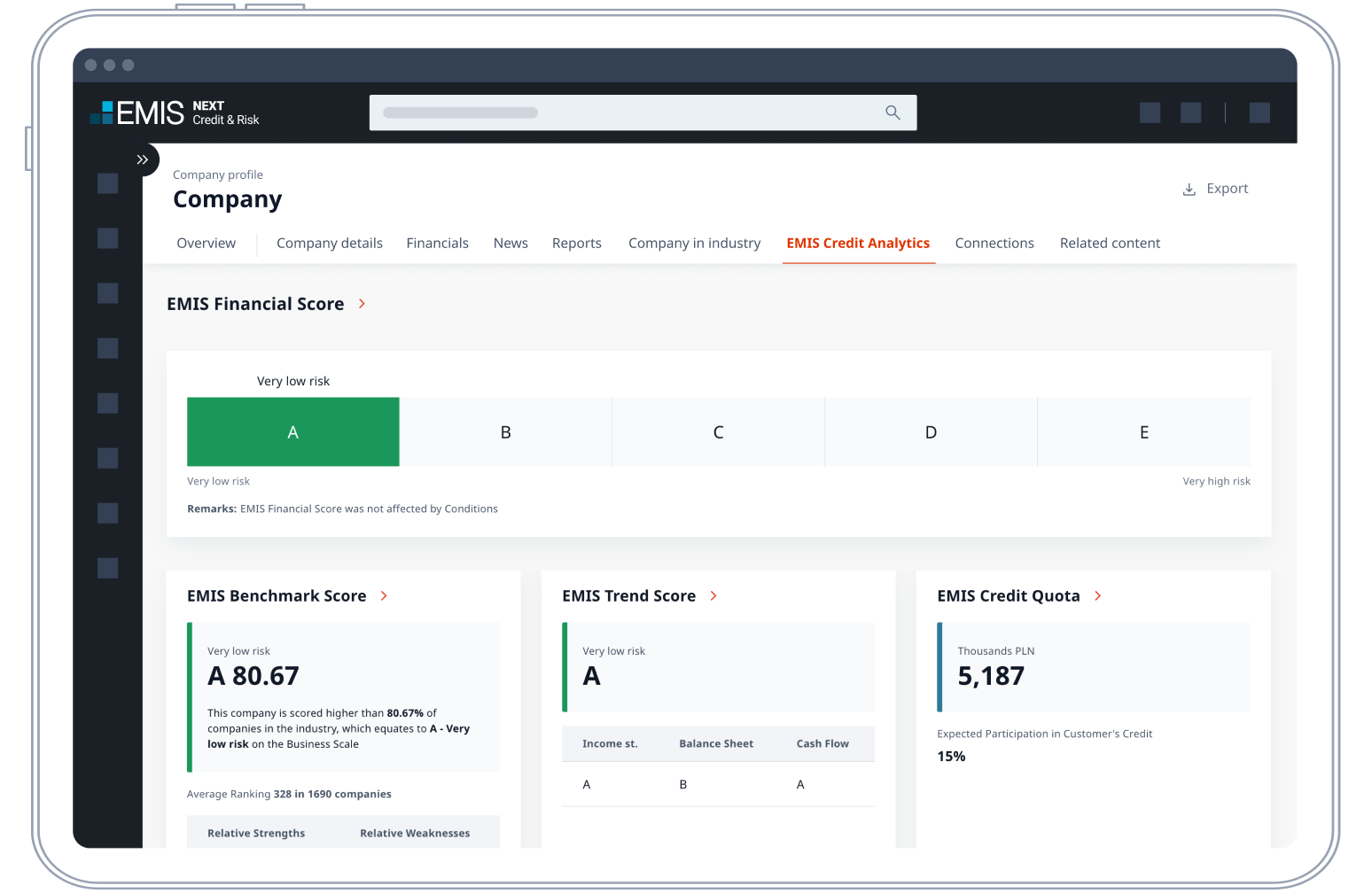

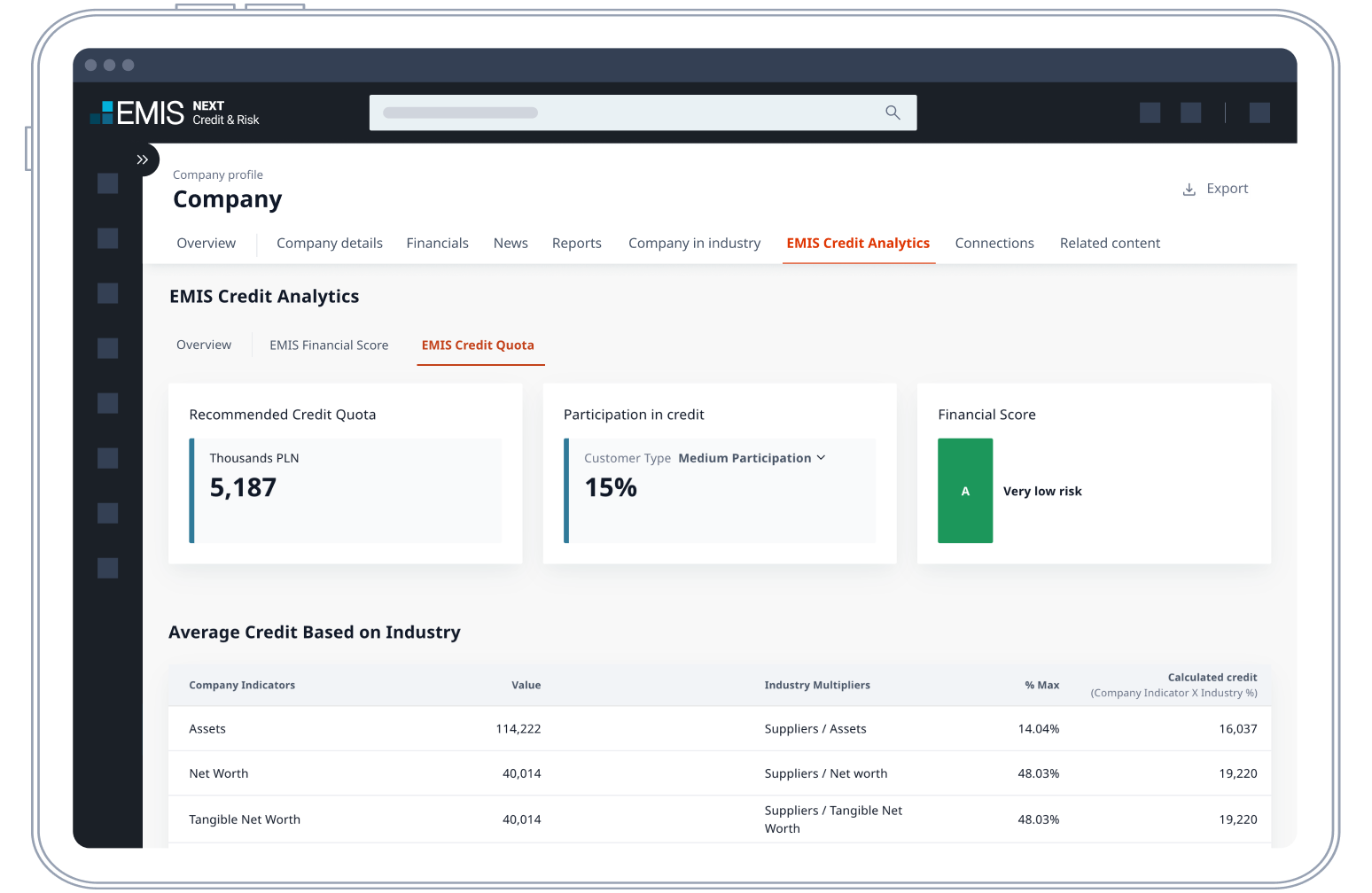

Generate credit scores and recommendations of credit quotas customised to your own policy. Export data directly into your own templates and refresh it automatically.

Efficiently monitor your portfolio

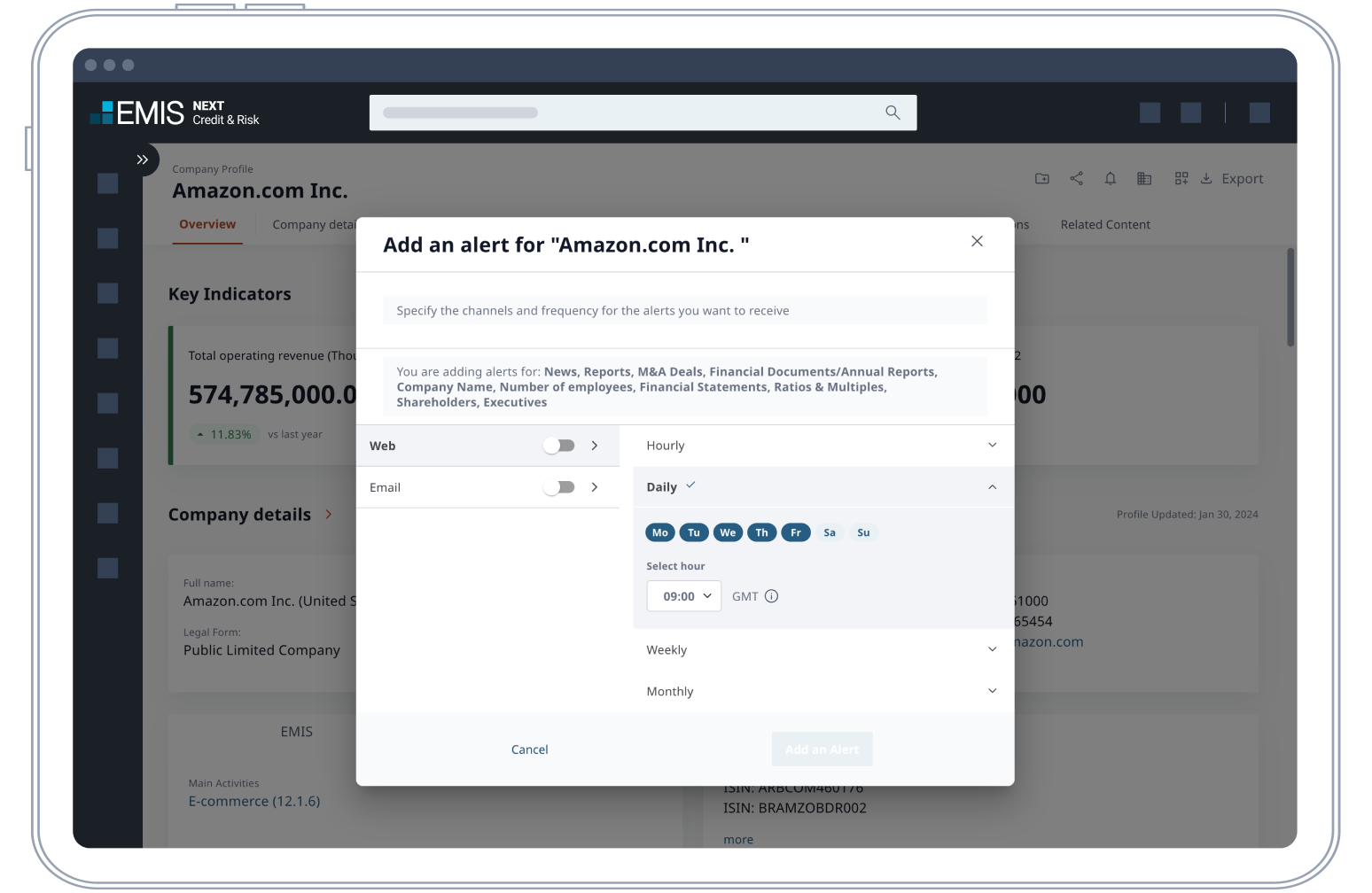

Track and monitor companies in your portfolio over time with news reporting and customised alerts.

EMIS: a one-stop intelligence platform

Deep and long-term company financial data and news to analyse creditworthiness and risk.

Benchmarking tools to allow you to assess the relative performance of the subject versus peers

A customizable credit analytics model enabling scoring and recommendation of credit quotas.

Industry profiles, statistics and benchmarks to understand the risk within a particular sector.

Featured information sources

EMIS curates over 4,500 sources. Here are some of the top information providers that the EMIS platform provides access to

Decisions supported by the best data. Learn more about our credit & risk solution.

Request demo